Simple, Seamless, and Reliable Coverage

First Policy: Catastrophic Short Term

Short-term medical insurance provides a limited duration medical insurance solution until a qualified health plan is chosen, helping reduce your financial risk. It allows you to pivot to help meet your life’s needs. There are no doctor or hospital network restrictions, so you have the freedom to choose where to receive care.

Important Plan Features:

- Up to $1,000,000 in benefits per coverage period

- Deductible options up to $10,000

- Annual OB-GYN exam, mammogram, ovarian cancer monitoring, colorectal cancer and prostate screening coverage

- Childhood immunizations and routine service coverage

- Inpatient and Outpatient Mental Health and Substance abuse benefits

- Organ transplant benefits

- HIV coverage

- Joint, neck, and spine injury coverage

- Freedom to choose any doctor or hospital–no networks

- Unlimited doctor office visits

- No network restrictions – choose any doctor or hospital

- Unlimited telemedicine benefits

- Annual wellness visit paid up to $200

OUR SUGGESTION

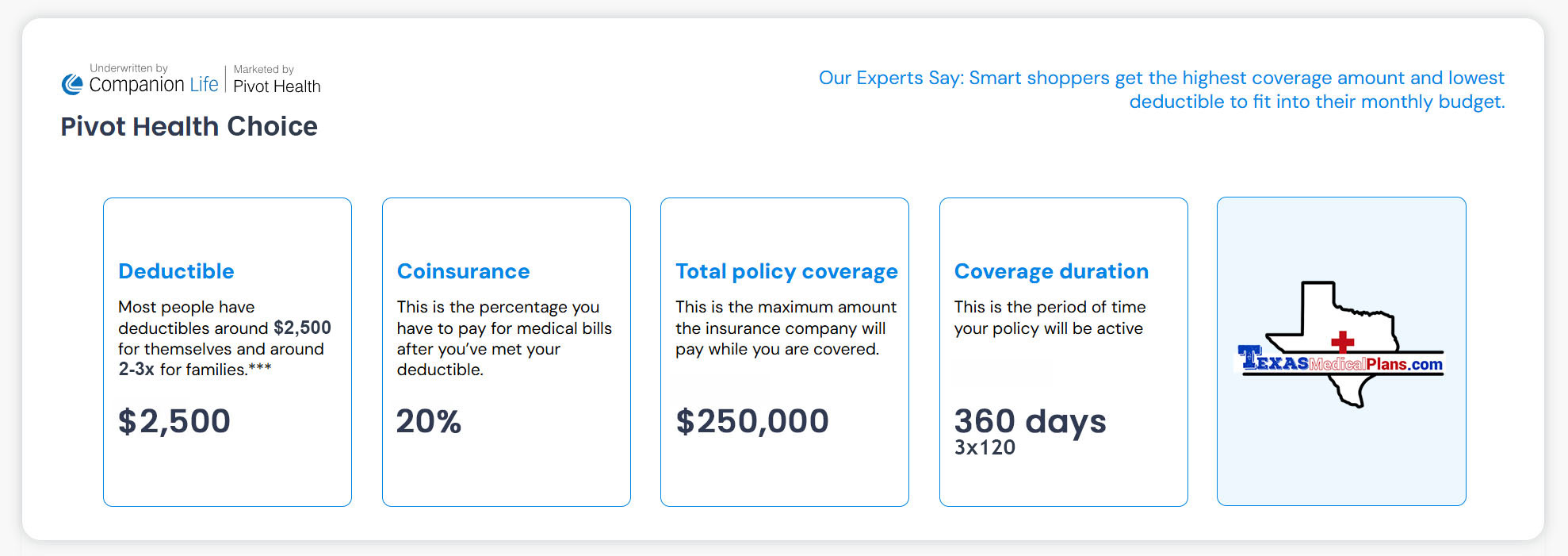

Pivot Health Choice

To see more details, please click here.

Optional PPO First-dollar plan for those who want the little things too

Second Policy: $0 Deductible for Daily Needs

First-dollar fixed benefits $0 ded. = Simple and Easy for daily needs.

- Hospital Benefit reduces main deductible

- Doctor Visits

- Urgent Care

- Labs & Tests

- Fixed RX Plans

- PPO Benefits

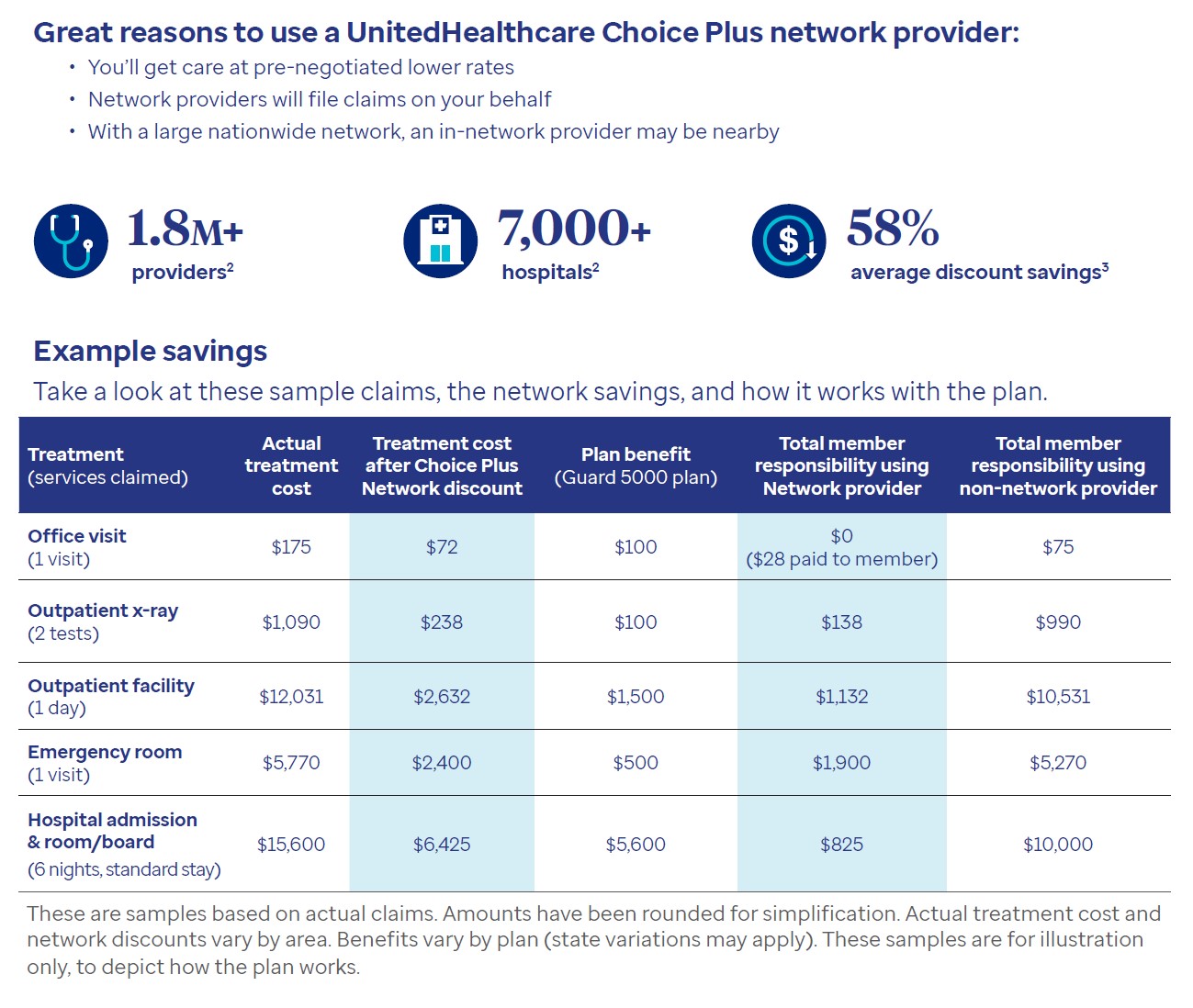

- 56% In-Network Savings

- Strong Nationwide Network

- 1.8 Million Doctors/Health Professionals

- 7,000 Hospitals/Facilities

UnitedHealthcare offers one of the largest networks in the U.S.

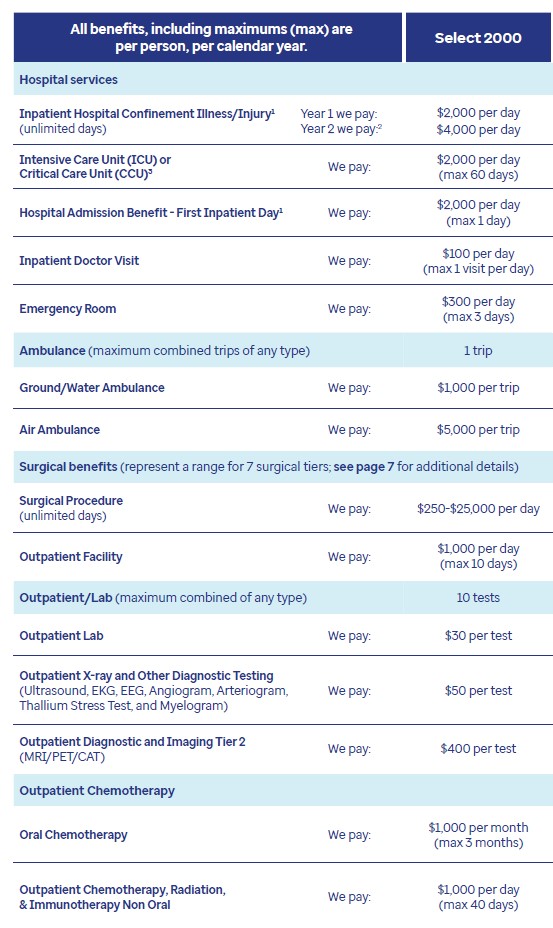

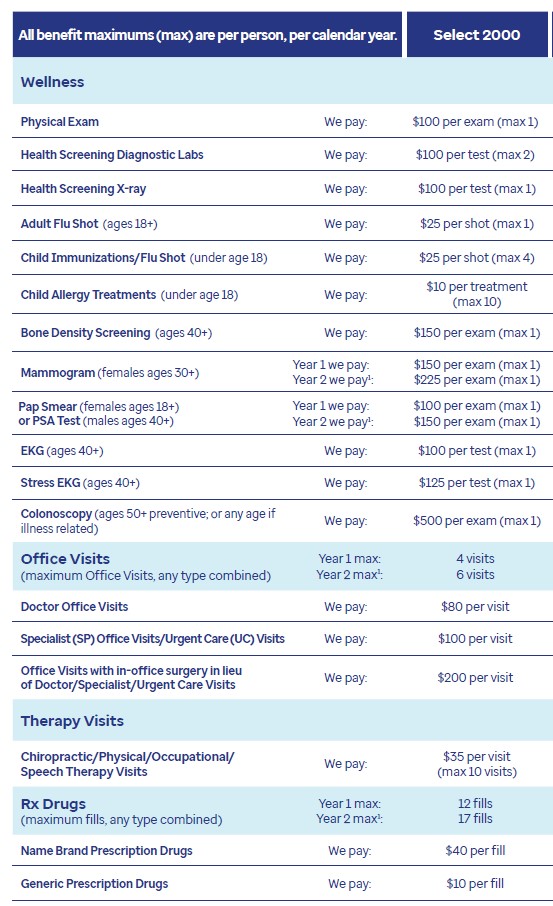

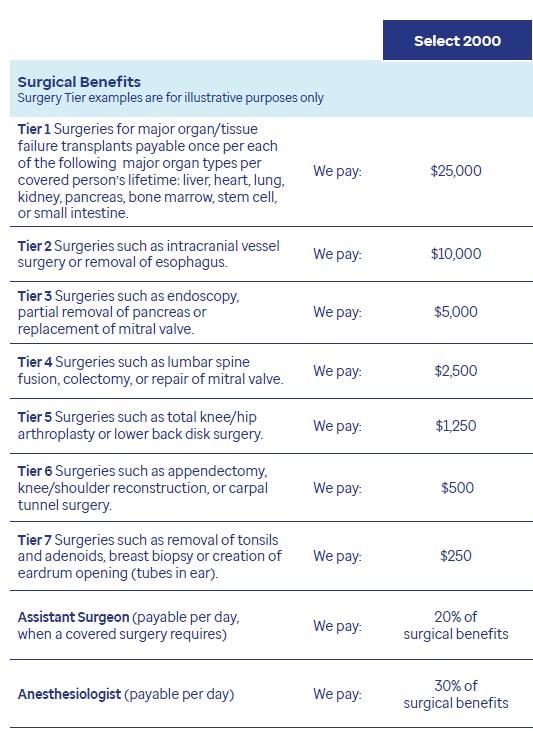

United Healthcare Guard Select 2000

Benefit Example

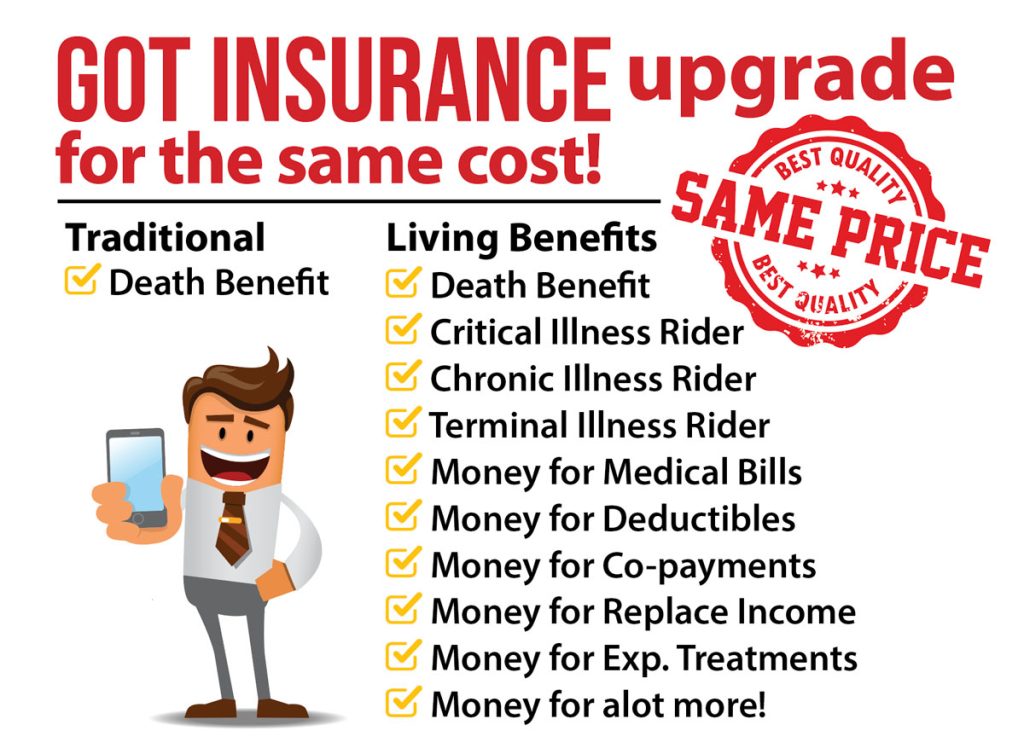

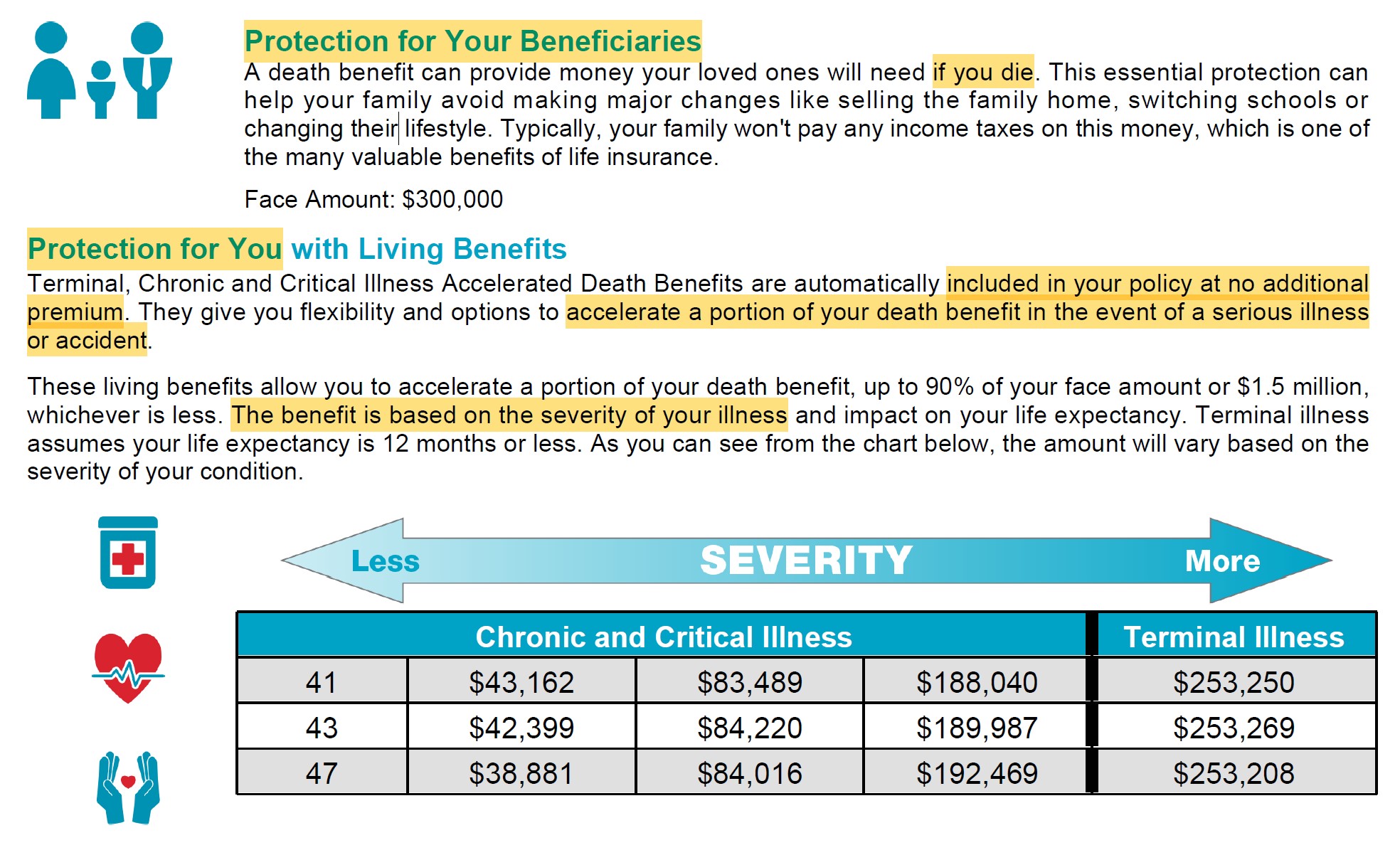

Why Living Benefits?

Purpose of the Living Benefits is to provide adult members that suffer a Critical – Chronic or Terminal illness a significant cash payment which can facilitate the future purchase of guaranteed issue coverage. Often the cost of these plans can be in excess of $20,000 a year in premium. However, expensive this maybe, it is often necessary to provide ongoing coverage for situations like significant cancers.